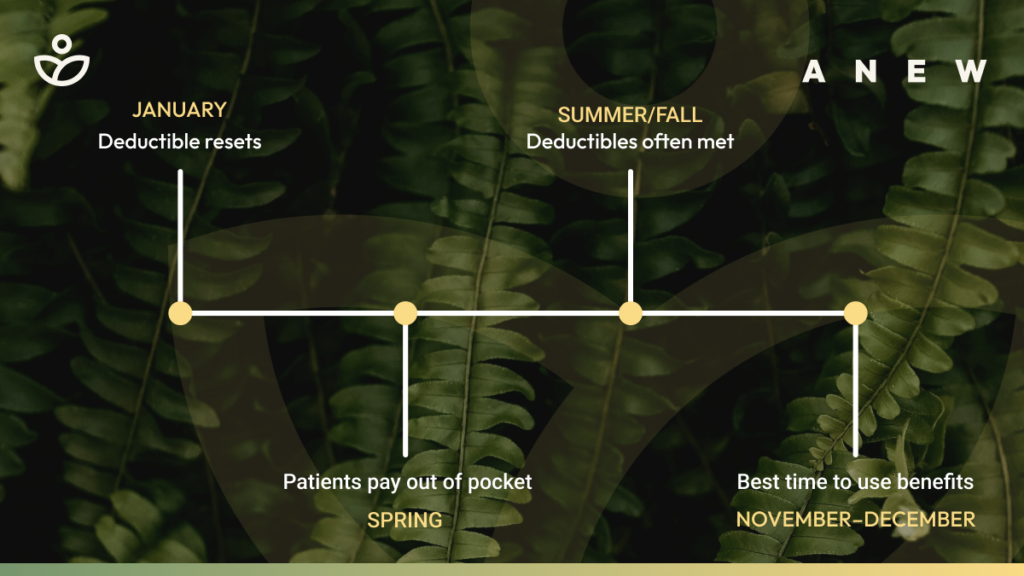

The end of the year is only three and a half weeks away, which means many things: Christmas, New Year’s resolutions, and the resetting of insurance deductibles. January brings the opportunity to reassess your benefits, plans, and coverage regarding mental health insurance deductibles. The average individual health insurance plan typically begins January 1st and ends December 31st. While there are many terms and moving parts encompassed in mental health insurance, this article highlights the best ways to maximize your mental health benefits with readily available options.

Key Takeaways:

- It is most cost-effective to use mental health insurance benefits after deductibles are met and before the beginning of the new year.

- Try new forms of treatment or schedule in-person appointments to find what is best for you – taking action with the benefit of insurance can help you have your healthiest holiday season yet!

Why Insurance Deductibles Reset in January

Deductibles reset for two main reasons: to manage financial risk for the insurance provider and to ensure a continued, steadyinflux of funds to keep insurance companies funded for further investments. Resetting deductibles keeps policyholders accountable to their responsibilities to maintain coverage by placing risk in their hands, allowing insurers to focus on larger, more severe claims. This system creates a shared responsibility among all parties to control perceived risks together, rather than placing the burden solely on the shoulders of one person, family, or company.

The calendar year schedule is the most commonly used, and is how insurance companies maintain steady funds for pouring money into their own company investments; which is how insurance companies make a profit. Essentially, insurance companies need to maintain their pool of support by charging monthly premiums and collecting deductibles, while the remaining amounts are invested elsewhere to grow profits. The calendar year aligns with standard fiscal planning, which is the schedule wherein insurance companies budget for and plan financial targets. This is also why most benefit plans follow the calendar and reset every year, often with increased deductible rates.

A Note on Mental Health Coverage With Insurance

A policy known as the Mental Health Parity and Addiction Act, passed in 2008, requires that health insurance treat mental health care equal to physical health care. Payments regarding mental healthcare, quantity of treatments, and out-of-network benefits are the same as physical healthcare. This also ensures mental healthcare is covered under your health insurance policy.

How To Maximize Mental Health Benefits Now

Reviewing your policy and where you stand with your current deductible can offer the best insight into how you can maximize your mental health insurance deductible. Deductibles that have been paid in full for the year, coupled with an in-network healthcare provider, is the best possible way to take advantage of mental health benefits. The main key here is to use insurance before deductibles reset in January. This strategy ensures mental health services are affordable, because after meeting your deductible, insurance will cover the greater cost of services (if not all).

Additionally, reaching the out-of-pocket maximum spending triggers the beautiful benefit of providers covering 100 percent of the bill. Cheaper and/or free coverage gives you the option to explore which treatment options work best for you, even if you have never been to therapy before. With this information in mind, scheduling appointments before the end of the year is the best way to maximize mental health benefits. If you’ve never been to therapy, schedule an introductory consultation to determine which treatments are most beneficial for you. Returners can maximize benefits by experimenting with different methods; after all, your insurance provider has got the bill, right?

At Anew Therapy Utah, branching out to try TMS, in tandem with talk therapy, could yield incredible results. Perhaps you would like to try injectables for improved cognitive and regulatory function. Whichever the case, maximizing mental health benefits all begins with action: meeting your deductible by paying out of pocket throughout the year, designating time to care for yourself by getting to the treatment of choice, and using every opportunity to expand your treatment options.

Alternative Method for Maximizing Mental Healthcare Benefits

FSA’s and HSA’s (Flexible and Health Savings Accounts) provide access to direct funds that can be applied to mental health services. Just like deductibles, FSA’s reset annually, and additionally have a “use it or lose it” system. Any leftover funds will not transfer to the total account the next year, so using your FSA may benefit you in two ways – if you want to keep your total available amount and keep costs down for therapy expenses. Check your policy to know which services and options are covered under your FSA funds. Usually, these can be used for appointments, online resources, and therapy sessions.

Action Steps for Next Year

Budgeting for Treatment

Distributing your deductible payments and setting a goal to have it all paid in full at a certain time of year is imperative to your treatment affordability. Planning for a certain amount of sessions per year can help you strategize how much you pay each month, and applicable copays after the deductible is met. Scheduling your sessions per month can give you a better understanding of how much you will spend on treatment throughout the year.

Switching Plans

End of the year also means open enrollment. This opportunity allows you to fine tune any gaps or switch to an alternative plan to use in-network providers for services you want. Furthermore, you can adjust your deductible and premium rates to fit your mental health needs: higher deductibles for lower premiums if you don’t go to treatment regularly, or switching to a low deductible plan if you intend to receive treatment more often in the coming year.

Final Thoughts

Understanding why insurance benefit plans reset annually and when your policy resets can help you make informed decisions about your treatment plans. Consistently reviewing your benefits and the status of your deductible will keep you on top of mental health benefit maximization, especially towards the end of the year. Planned accordingly, you won’t have to wait until the end of the year if you don’t want to!

At Anew Therapy Utah, we offer free consultation phone calls for new and existing patients. Our Care Coordinators are happy to answer any questions you may have about insurance coverages and treatment options. Call us or text us at (801) 980-2690, or schedule a free consultation online.

You are not alone on your journey to live a healthier life, or on figuring out all the intricacies of insurance. Reach out with any and all questions because you’re always worth it.

Crisis Support Resources

- Utah Warm Line: 1-833-SPEAKUT (1-833-773-2588)

- 988 Suicide & Crisis Lifeline: Call or text 988